It is a simple and easy payroll software system by allowing your company employee SOCSO calculation Malaysia can be done easily and efficiency. The Hargrave decision largely relies on Parrish vPremier Directional Drilling LP 917 F3d 369 5th Cir.

Indonesia Payroll What Is Bpjs Kesehatan Jpk And How Is It Applicable In Deskera People

6 The Minister may make regulations for the purpose of calculating the payment.

. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. LABOUR LAWS IN INDIA. All such contributions are required by the Malaysian Legislation.

2019See the previous blog. Users can further customise the computation for allowance overtime and shift calculation with a built-in formula builder. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

People also downloaded these free PDFs. This contribution is paid into Employee Provident Fund or KWSP in Malay. IFLEXiHRMS Payroll System free up your time from tedious and complex payroll calculations preparation.

A resident employees PCB calculation are categorised into four formulas. Hong Kong labor law does not set specific requirements regarding overtime work including any requirements to pay for overtime work. People also downloaded these PDFs.

B For the purposes of the restriction on overtime under this subsection overtime shall have the meaning assigned thereto in subsection 3 b. SQL Payroll is the only software that you would ever need to use for your Payroll. LAWS OF MALAYSIA EMPLOYMENT ACT 1955.

Net PCB RM 500000 x 28. Having different types of payment modes for your employees is not a problem as it can calculate hourly daily and monthly salaries. Total monthly remuneration RM 500000.

However the law states that if the employment contract provides payment for overtime work the employer is legally obligated to provide such wages and will be subject to a fine for withholding wages. A short summary of this paper. As an extension of Parrish the Hargrave case with the Fifth.

Overtime payment is treated the same as. Full PDF Package Download Full PDF Package. Malaysia follows a progressive tax rate from 0 to 28.

SQL Payroll Software ready with all HR management eLeave PCB tax calculator specific contribution assignment and automatic overtime calculation. A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. This best payroll software in Malaysia can handle multiple company transactions at a time.

SQL Payroll Software removes the complexities in Human Resources Management make your payroll process easier. 1 Normal Remuneration Normal remuneration is a fixed monthly salary. 1 Full PDF related to this paper.

An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. For a non-resident employee in Malaysia the net PCB should be 28 of his or her salary. In addition contributions are also made to Social Security Organization or PERKESO in Malay.

In addition to monthly salaries Malaysian employers are also bound to contribute to the EPF EIS and SOCSO accounts of their employees. The Fifth Circuit just issued its opinion upholding the summary judgment decision of Judge Morales in the Corpus Christi Division of the Southern District of Texas.

The Malaysian Legal Environment The Legal Environment The Employment Act 1955 The Children And Young Persons Employment Act 1966 The Wages Council Ppt Download

How To Calculate Overtime For Salary Employees In Malaysia Madalynngwf

Employment Law Calculation For Payment Of Overtime Work Chia Lee Associates

Must Know Malaysia Leave Types And Overtime Pay Rates The Vox Of Talenox

How To Calculate Overtime For Salary Employees In Malaysia Madalynngwf

Payroll Setup Dna Hr Capital Sdn Bhd

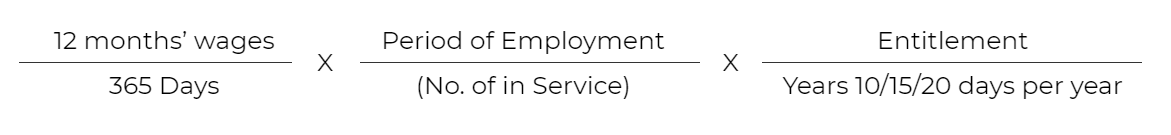

Payroll Malaysia Formula Calculations Of Encashment For Annual Leave Youtube

What You Need To Know About Payroll In Malaysia

Gps Timeattendance Payroll Projectmanagement Workforce Management Cloud Services Hr Management

What You Need To Know About Payroll In Malaysia

Getting Started With Swingvy Time Time And Attendance Tracking

Malaysia S New Minimum Wage To Take Effect From 1 May 2022 What Employers Should Note

Employment Law New Minimum Wage Rates To Take Effect On 1 February 2020 Lexology

Employment Law Calculation For Payment Of Overtime Work Chia Lee Associates

What Is Form Pk L Co Chartered Accountants

How To Calculate Overtime A Guide For Work Addicts

Iza World Of Labor Do Labor Costs Affect Companies Demand For Labor

Payroll In Excel How To Create Payroll In Excel With Steps

Working Overtime In Malaysia Here S What You Should Know By Legal Street Medium

- rumah kecil hitam putih

- bulu mata yg bagus

- kata bijak dalam prajurit

- pakaian tradisional amerika serikat

- jawatan kosong guru sekolah swasta

- penyakit kuning obatnya apa

- contoh gambar hiasan kelas kemerdekaan

- nama latin bunga peony

- contoh format pengeluaran harian

- running man rating tertinggi 2017

- diploma pengurusan perkhidmatan makanan

- noryati binti mohamad yusop

- daftar mengundi di pejabat pos

- resipi ikan bawal masak merah

- undefined

- overtime calculation in malaysia

- nike tanjun malaysia price

- new perodua suv 2019 malaysia

- part time job online malaysia

- oleh oleh khas malaysia